Surviving Silver

If you are like most people you stumbled across silver by accident while not really looking for it. To define it even more many people found silver looking to make a quick buck and then realized the importance of silver is so much more. Stacking silver can and will be able to help you survive the storm that is coming. Without silver, at your personal disposal, you quite literally will suffer the fate so many millions of people are already beginning to suffer around the world. Yes, the suffering has already begun.

Preparation

I have been preparing for slightly over one year. Fourteen months to be precise and have realized I will never be fully ready. The problem I have encountered is life itself. It is like trying to be able to afford a separate and hidden lifestyle. It is almost like I am supporting a separate and hidden family living in another city. Trying to juggle the bills and keep the lights on at home WHILE attempting to accumulate a stash of money called silver has not been easy.

I hear other YouTube channels talk about diversifying and buying this and that and stacking on and on. That is not me. Preparation for me has been either a cup of coffee at the store or an ounce of silver next month. Preparation has resulted in what appears to be barely above poverty while the choice to prepare moves forward as time allows. I have learned that preparation is a very personal thing and is different for everyone.

Buying Silver

The first purchase of silver was like losing virginity as just about everything was done wrong. The first ever act of buying silver finished up even though it was clunky and clumsy. As time went by learning about buying silver helped things get better with each and every purchase.

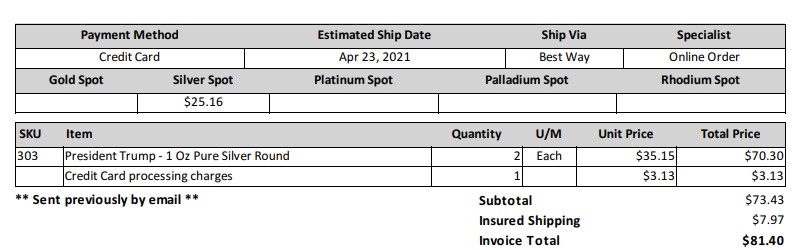

An early example of gained knowledge is that eBay is not a great place to get silver. Experience teaches it is cheaper to purchase silver using a bank ACH (Automated Clearing House) with an established private mint. Learning about silver became vital to me because one can see the future economic events unfolding similar to what happened in history. Through the eyes of those that have come before us it will soon be realized that trying to save a penny here, or a penny there is not going to be of any importance.

Dollar Cost Averaging

Dollar cost averaging is the practice of investing a fixed dollar amount on a regular basis, regardless of the share price. It’s a good way to develop a disciplined investing habit, be more efficient in how you invest and potentially lower your stress level—as well as your costs. Dollar cost averaging is what shall ensure profits in the future, at least for me.

The real money in silver will not be made when you buy it, it will be when you sell it. That seemingly is a ‘No-Shit’ type of statement but there is a deeper meaning. A much deeper meaning. I say this because the day will come when silver will not be available at the retail level as it is today. A person will only to bring what they have when that day abruptly arrives.

What is Coming

I must clarify that everything I say is my opinion. Everyone has an opinion and it is just that I base my opinion on historical fact while most other people hate history. Some people are computer geeks while others are gaming geeks. If you ask them why they are geeky they do not know anything more than that they love it. Loving it is what makes them so good at it. I love history and always have. I am a history geek and I love it. I see the current events of today differently than the mainstream. What has been seen been cannot be unseen. Unfortunately for the world the war has already begun and it is at our doorstep already. It is not what is coming… it is what has already begun. We are watching the drama unfold as markets implode before our eyes and few fail to really heed the warning signs.

Dollar Reboot

The power of America is her military. That military is powered by money. Without money the military would be reduced to an empty shell. The aircraft carriers would rust in port and future YouTubers would make videos touring the cavernous and abandoned behemoths called aircraft carriers. Money is the grease that keeps the machine running. The Federal Reserve is not going to merely squander away its number one transparent asset, which is the U.S. military. So the real question will be how does the military emerge on the other end of the reset?

I Don’t Care Anymore

While other worry about that question I am simply concerned with silver and the future value it will hold. I am only concerned with how silver will go from being a completely underrated metal to a powerhouse of financial opportunity. How will the lowly ounce of silver emerge when things start to heat up even more economically?

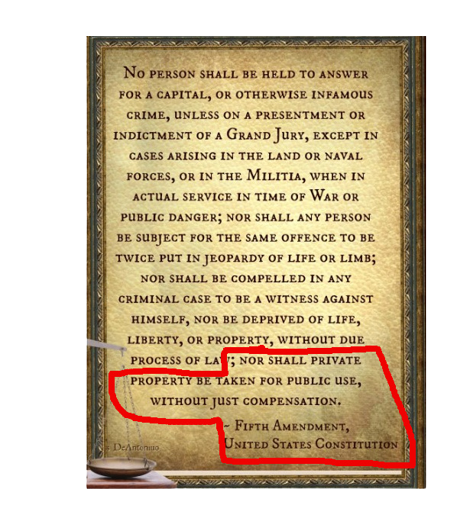

5th Amendment

When the Treasury took control of all the nation’s gold during the Depression under the Gold Reserve Act of 1934, it also took control of the Federal Reserve’s gold. The Treasury gave the Federal Reserve a gold certificate as compensation under the Fifth Amendment (to this day, that gold certificate is still on the Fed’s balance sheet).

The Eisenhower administration was up against the debt ceiling and Congress didn’t raise the debt ceiling in time. Eisenhower and his Treasury secretary realized they couldn’t pay the bills.

What happened?

They turned to the weird gold trick to get the money. It turned out that the gold certificate the Treasury gave the Fed in 1934 did not account for all the gold the Treasury had. It did not account for all the gold in the Treasury’s possession.

The Treasury calculated the difference, sent the Fed a new certificate for the difference and said, “Fed, give me the money.” It did. So the government got the money it needed from the Treasury gold until Congress increased the debt ceiling.

That ability exists today. In fact, it is exists in much a much larger form, and here’s why…

Right now, the Fed’s gold certificate values gold at $42.22 an ounce. That’s not anywhere near the market price of gold, which is about $1,800 to $1,900 an ounce.

The Treasury could issue the Fed a new gold certificate valuing the 8,000 tons of Treasury gold at $1,900 an ounce and subtract the official $42.22 price, and multiply the difference by the 8,000 collateralized tons of gold. That number comes fairly close to $500 billion. In other words, the Treasury could issue the Fed a gold certificate for the 8,000 tons in Fort Knox at $1,900 an ounce and tell the Fed, “Give us the difference over $42 an ounce.”

The Treasury would have close to $500 billion out of thin air with no debt. It would not add to the debt because the Treasury already has the gold. It’s just taking an asset and marking it to market. It’s not a fantasy. It was done twice. It was done in 1934 and it was done again in 1953 by the Eisenhower administration. It could be done again. It doesn’t require legislation.

Why limit themselves to only $1,900 an ounce? The higher the number set the more money created out of thin air. I will end it there and let that swish around in your brain awhile.

Previous Video

I put out a video months ago saying that math shows me that silver will quickly hit at least $333.00 and ounce. It is simple math on an ancient equation. An equation that has been used by humans for over 6,000 years. It is called the gold to silver ratio.

One plus one still equals two. Even after 6,000 years.

Please do not waver in your quest to prepare for the reset. Described is but one possible scenario and nobody really knows what is going to happen. The only thing we do know is something is going to happen and the true value of silver will prevail. Since you now have ‘inside‘ information about the future direction of silver it really only comes down to your convictions of belief. How well you prep will prove the old axiom correct when that day erupts on the world stage. Once that happens the time for preparing will be over and you only be able to bring what you have.

You can pick apart the math or you can just start getting shit done.

Semper Fi!